From Tariffs to Training: Ontario’s Budget Blueprint 2025

Finance Minister Peter Bethlenfalvy has tabled the first Budget of the Ford government’s third term – A Plan to Protect Ontario. Following a snap winter election centered on countering US tariffs, the government is now focused on protecting businesses and workers from trade impacts while addressing continued issues around housing, healthcare, and public safety.

The Budget largely reflects the commitments outlined in the PC Party’s election-time document, Our Plan to Protect Ontario, relying on the familiar themes of supporting workers and businesses alongside strengthening (protecting) public services. This focus reflects the severity of the economic challenges Ontario appears to be facing, as the fiscal and economic outlook projected is significantly diminished from even a few months ago.

A focus on Ontario jobs and the economy

The Budget emphasizes economic resilience and long-term competitiveness, with a focus on protecting workers and supporting trade-disrupted and other priority industries. New spending in workforce development is intended to ensure a steady pipeline of talent for priority sectors, while building capacity to up-skill or re-train workers impacted by the trade dispute. The province is also spending to support strategic industries it views as critical to the PC’s “Protect Ontario” mandate, like energy and nuclear, advanced manufacturing, and critical minerals.

- Businesses – six-month tax deferral window for select provincial taxes and creating the Protecting Ontario Account to provide up to $5 billion in support to trade-impacted businesses.

- Workers – $20 million to create new training and support centres to help workers re-skill and find jobs, an additional $1 billion to the Skills Development Fund, and a further $750 million spending on STEM-related programs to expand training opportunities.

- Strategic Industries – $500 million to create a Critical Minerals Processing Fund; additional spending to Venture Ontario focused on AI, cybersecurity, and life sciences; and increasing the Ontario Made Manufacturing Investment Tax Credit to support the manufacturing sector.

Addressing housing, healthcare, and public safety

With housing affordability, healthcare access, and public safety remaining top concerns for many families, the government is directing new funding toward infrastructure, frontline services, and community protection. These measures are positioned as part of the broader effort to “Protect Ontario” by addressing cost pressures, reducing wait times, and enhancing safety across the province.

- Housing – additional funding to Invest Ontario to grow modular housing capacity, $400 million to municipal infrastructure funds (Municipal Housing Infrastructure Program and Housing-Enabling Water Systems Fund), and allowing municipalities to reduce property taxes on affordable rental housing by up to 35 per cent (starting 2026).

- Healthcare – $103 million in planning grants to advance seven hospital infrastructure projects, further expansion of Integrated Community Health Service Centres to improve access to diagnostic and select procedures, increased training incentives for nurses, doctors, and other healthcare professionals through the Learn & Stay Grant.

- Public Safety – $57 million for two helicopters and increased enforcement for Niagara and Windsor police at key border entries, $6 million to the Preventing Auto Theft Grant, and continuing the Anti-Hate Security and Prevention Grant for faith-based and cultural groups.

By the Numbers

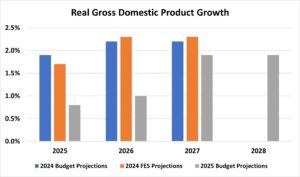

The economic indicators in the Budget paint a relatively grim picture. The government anticipates gross domestic product (GDP) growth to come in at only 0.8 per cent for 2025, which is significantly lower than past projections. The effects of the U.S. tariffs are expected to persist as the Budget forecasts only a 1 per cent GDP increase for 2026. Job creation projections have been drastically slashed as a result of this negative outlook, which also means higher unemployment rates.

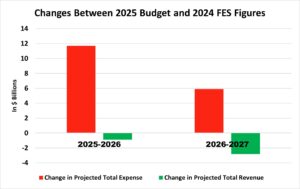

On the fiscal side, the Budget projects a much larger deficit for 2025-2026 (-$14.6 billion) than the 2024 Fall Economic Statement (FES) did (-$1.5 billion). A bigger deficit is also expected in 2026-2027 (-$7.8 billion). For both years, the differences are attributable to higher anticipated total expenses and lower total revenues. The government looks to balance the budget in 2027-2028.

Opposition Reaction

Marit Stiles, Leader of the Official Opposition calls the Budget “a missed opportunity.” The NDP criticize the government by saying insufficient spending in education, housing, and healthcare will negatively impact Ontario’s ability to respond to trade disruptions. Similarly, Liberal Leader Bonnie Crombie released a statement saying the Budget fails to adequately address the healthcare, education, housing, and affordability challenges facing Ontarians.

The Road Ahead

As the government looks ahead, it will need to demonstrate that its trade-focused plan delivers real, measurable benefits. With priority spending on worker training, business supports, and strategic industries, the success of the “Protect Ontario” approach will hinge on job creation, industrial growth, and how effectively these investments shield the province from potential economic shocks.

At the same time, affordability remains a central concern for Ontarians—featuring strongly in the recent provincial and federal elections. With the federal carbon tax no longer in effect, the PCs will also now face pressure to show their own action on housing costs and cost-of-living pressures. The Budget features modest affordability measures, as well as updates on the government’s efforts to improve access to healthcare and accelerate housing development. Success in these areas will be critical as Ford enters his seventh year as Premier – nearly double the tenure of his predecessor – as he will be increasingly required to demonstrate his own progress.