Canadians on pandemic-era customer service: “Let me talk to a real person”

2020 was an anti-social year. Since the Covid-19 pandemic began, Canadians were encouraged to do everything from investing to buying liquor without ever speaking to another human. Grocery delivery went mainstream. Apps dominated – not just for Covid screening tools or meal delivery startups, but telecom and financial services giants expanded their digital offerings, too.

2020 was an anti-social year. Since the Covid-19 pandemic began, Canadians were encouraged to do everything from investing to buying liquor without ever speaking to another human. Grocery delivery went mainstream. Apps dominated – not just for Covid screening tools or meal delivery startups, but telecom and financial services giants expanded their digital offerings, too.

We’ve known for some time that the future of customer-company interaction is digital. It’s easy to see how the pandemic accelerated those trends. As the world went contactless, we saw significant investment in new or enhanced artificial intelligence (AI) tools—like chatbots—to handle customer service traffic.

Their cost-savings and efficiency for customer service providers have been touted for years. But with the rapid ramp-up of customer-machine interactions, has anyone stopped to ask: do Canadians actually like the new normal?

Their cost-savings and efficiency for customer service providers have been touted for years. But with the rapid ramp-up of customer-machine interactions, has anyone stopped to ask: do Canadians actually like the new normal?

Do consumers have good experiences with AI-based customer service? And can a shift to chatbots and automation have a negative impact on consumer trust and a brand’s reputation?

Prevailing Bottom-line Wisdom

When the Covid-19 pandemic began, countless reports were issued by business consulting firms and industry thought leaders about how the global crisis provides ample opportunity for customer service to finally embark on a full digital transformation. The impetus was not new: AI is supposed to increase productivity and save money. But Covid protocols, including the closure of offices and call centres, could act as an accelerant.

The world’s largest management consulting firm, McKinsey & Company, authored several reports praising the technological advancements in human-machine interaction. As this technology matures, an increasing amount of “administrative” work done by people can be transferred over to chatbots and AI customer service which are cheaper and more efficient.

Research statistics abound; chatbots enhance productivity and efficiency. Customer service managers have been reporting bottom-line success. Another McKinsey report that includes “robotic process automation (RPA), and chatbots” as part of a digital transformation package cites benefits to companies like “15 to 30 percent improvements in labour productivity, 10 to 30 percent increases in throughput, and 10 to 20 percent decreases in the cost of quality.”

Not to be outdone, Boston Consulting Group finds that telecom companies can utilize “new technologies to reduce incoming customer calls [to] generate significant savings,” and boast a “a call deflection rate of 20% to 40%… resulting in a 10% to 20% decrease in call centre costs.”

Not to be outdone, Boston Consulting Group finds that telecom companies can utilize “new technologies to reduce incoming customer calls [to] generate significant savings,” and boast a “a call deflection rate of 20% to 40%… resulting in a 10% to 20% decrease in call centre costs.”

From a management perspective, a transition to AI is often found money. Accord to IBM, chatbots for customer service would cut operational costs and save businesses $8 billion per year.

Sounds good, right? But is there a catch?

Can (Saving) Money Buy Happiness?

In promoting AI-based approaches, the pitch is often win-win: happy managers see greater efficiency and cost-savings, and happy customers have their concerns triaged and resolved swiftly.

“Migrate customers to digital channels to save money and boost satisfaction,” proposed one McKinsey publication.

The CEO of Finn.ai (“Conversational AI built for banking”) claims his company’s technology offers “productivity improvement, cost savings and happier customers,” for financial institutions.

Let’s break this down: we know companies can save money as labour becomes automated. And we also know the cheery statistics reflecting AI’s operational gains and management success. But happy, satisfied customers? People who will continue to trust your company and think highly of its reputation?

Let’s break this down: we know companies can save money as labour becomes automated. And we also know the cheery statistics reflecting AI’s operational gains and management success. But happy, satisfied customers? People who will continue to trust your company and think highly of its reputation?

Well, the statistics are more dubious. They often sound like this from TechRepublic: “Teams that use chatbots to automate conversations are 27% more likely to meet rising customer expectations than those that don’t.”

Are those really happy customers, having their expectations met just 27% more often? What about the 73% of teams who are perhaps less likely to meet expectations?

And what about the customer so disillusioned by being unable to speak to a real person that they don’t even bother, and instead go line up at the store, six feet apart and in masks—provided the outlet is still open amid lockdown restrictions. Or could that inconvenience, in the case of sectors like investment management or insurance services, cause consumers to prefer a local broker who’s only a phone call away?

A Virtual Reality Check

Here at StrategyCorp, rapidly accelerating customer service automation during the pandemic sounded like a risk to brands’ hard-earned reputations. It was hard to reconcile claims of happy customers with what many of us have experienced over the past year, stuck in a loop of robotic agents with no live person to talk to about the matter.

So we decided to ask a nationwide sample of 400 Canadians what they think of these new, virtual solutions for handling their customer service needs.

Canadians: “Let Me Talk to a Real Person”

Our data shows that Canadians do not like the new normal. These are the toplines from our original research on Canadians’ opinions of AI-based customer service:

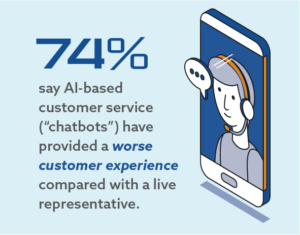

- 74% say AI-based customer service (“chatbots”) have provided a worse customer experience compared with a live representative.

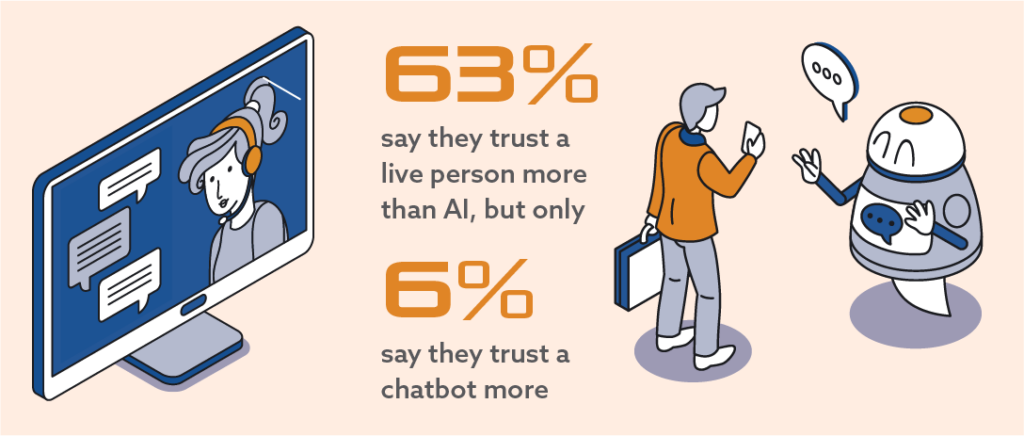

- 63% say they trust a live person more than AI, but only 6% say they trust a chatbot more.

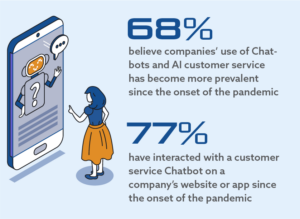

- Only 24% report better customer service during the Covid era, even though the vast majority agree (68% to 16%) that chatbots and AI-based agents have become more prevalent since the onset of the pandemic.

- Exactly 6 in 10 (60%) say they will view a company’s reputation more negatively if that company does not return to live agents in chatbot roles, while less than 1 in 10 (9%) see a positive impact.

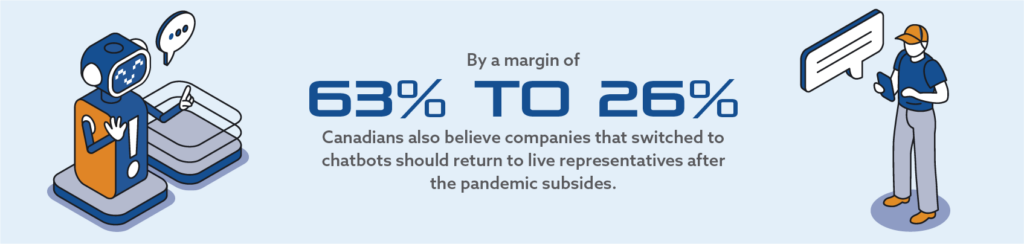

- By a margin of 63% to 26%, Canadians also think companies that switched to chatbots should return to live representatives after the pandemic subsides.

Short-Term Gain, Long-Term Reputational Pain?

Theoretically, chatbots should be able to satisfy customer needs, but as often is the case, artificial intelligence isn’t able to replace emotional intelligence. A machine can be trained to anticipate answers to common questions, but it can’t be programmed to empathize with frustrated customers.

And according to a survey by HubSpot, 93% of consumers are more likely to purchase again from brands with exceptional customer service. However, 51% of customers would never do business with a company after just one negative experience.

Last fall, yet another report argued that AI would transform the finance services sector. Yet even in year two of the pandemic, the lineups outside Canadian banks—for assistance that is usually available in-app—are still often noticeably long. Perhaps robotic financial advisors were not fully equipped to solve the banking problems customers faced.

The idea of a “reimagined engagement layer that would [provide] the AI bank with a deeper and more accurate understanding of each customer’s context, behavior, needs, and preferences” has yet to be realized.

According to Gary Marcus, NYU professor and former head of autonomous driving at Uber, deep-learning algorithms are still brittle.

“The pandemic and the current business challenges in applying AI are a wake-up call about how [lousy] the AI we’re building is,” he told the Wall Street Journal. Even in good times, he says, small- and medium-sized businesses simply don’t have enough data to train useful AI systems and that these algorithms are prone to break down. And new studies have found that AI algorithms have not significantly improved or advanced over the years.

When miscommunication happens between customers and the company, reputation and brand trust begin to diminish. The inability to easily access human interaction when dealing with simple service issues can be so frustrating that it can easily break a company’s social standing.

Bottom Line: Reputation Matters

The future may be digital—but we’re not there yet.

The future may be digital—but we’re not there yet.

In the meantime, it’s clear that too quickly advancing AI-based customer experiences can jeopardize a company’s reputation and its customers.

Our data and experience in reputation programs yields some advice:

- Beware of the allure of short-term savings that chatbots may bring

- Covid protocols require adaptive responses from customer-facing businesses, but the pandemic should not be exploited as opportunity for labour reductions and increased automation

- Canadians do not like the new normal and would like to talk to a live person

- Reputations are at stake: a majority of consumers may penalize a company that makes its automation permanent after the pandemic eases

In spite of the pandemic—and perhaps due to the human connections we’re craving amidst the pandemic—Canadians still overwhelmingly care about getting real customer service help, in real time, from a real person.