2021 Ontario Budget: Pandemic Management & Economic Recovery

As expected, Ontario’s 2021 Budget attempts to straddle the line between pandemic management and pandemic recovery. Investments in contact tracing, vaccination rollouts, and hospital capacity help to ensure the health care system can continue to handle the stresses of the COVID-19 pandemic. This spending lays the groundwork for a concerted economic recovery effort where the government has clearly chosen to put the recovery of the province’s economy ahead of the recovery of its own finances.

As expected, Ontario’s 2021 Budget attempts to straddle the line between pandemic management and pandemic recovery. Investments in contact tracing, vaccination rollouts, and hospital capacity help to ensure the health care system can continue to handle the stresses of the COVID-19 pandemic. This spending lays the groundwork for a concerted economic recovery effort where the government has clearly chosen to put the recovery of the province’s economy ahead of the recovery of its own finances.

Introduction

The 2020 Ontario Budget was released a mere five months ago, delayed because of the all-consuming impact of the COVID-19 pandemic. Budget 2020 held the projected deficit for 2020-2021 at a record $38.5 billion. Likewise, Ontario’s net debt was projected to surpass $400 billion in 2021-2022 for the first time ever. Five months later, Budget 2021 projects a deficit of $33.1 billion for 2021-22 and a steady increase to Ontario’s net debt. With a balanced budget expected in 2029-2030, Ontario’s debt will continue to grow over the next nine years.

These numbers, though jarring, are the result of a struggling economy mired in closures designed to protect Ontarians’ health along with increased expenses to fight the virus across the vast areas of provincial responsibility, primarily health and long-term care. For example, this year’s budget includes a $1.8 billion commitment for hospitals and $1 billion for a province-wide vaccination plan.

Commitments like these reflect Ontario’s continued battle with COVID-19. With the province only recently coming out of its second province-wide lockdown, and phase one of vaccine rollout underway, Ontario’s Chief Medical Officer of Health recently announced that the province is already in a third wave of the pandemic due to the rising case numbers involving variants of the virus. Even with phase two and three vaccine rollout on the horizon, the possibility of a future lockdown, or prolonged restrictions, remains unknown.

In his first Budget, Minister of Finance and President of the Treasury Board Peter Bethlenfalvy is tasked with straddling the unpredictable fault line between successful vaccine rollout – and thus an accelerated reopening of the economy – and the threat of resilient variants of the virus that could spread COVID-19 faster than ever before. In essence, that means the Budget has the unenviable job of putting forward policy directions that both aim to manage the pandemic and kickstart the recovery from it. No easy task given the already tight fiscal situation Ontario finds itself in.

Fiscal and Economic Outlook

Budget 2021 builds on the government’s existing response to COVID-19, now totaling $51 billion in support over four years. This includes direct support of $16.3 billion for health and long-term care, $23.3 billion in direct economic supports, and a further $11.3 billion in cashflow support for people and businesses. In 2021-2022 the government’s planned expenditures exceed $180 billion, building off the previous year’s record high of $190 billion.

This staggering figure can be divided between base funding (regular programs and expenses) and COVID-19 Time Limited Funding. COVID-19 Time Limited Funding totals $20.1 billion in 2021-2022, with a decrease to $6.7 billion in 2021-22 and $2.8 billion in 2022-23, before ending entirely in 2023-2024 – indicated the government’s expectation that the immediate needs related to the pandemic will quickly decrease as vaccines are distributed and the economy reopens. Over the same medium-term outlook, base funding slowly increases to $166.3 billion in 2021-22 to $171.1 billion by 2023-24. This is an important distinction. The separation between base funding and COVID-19 funding demonstrates that most of the COVID-19 supports will not be rolled into the province’s actual program spending, meaning they will not contribute to Ontario’s already high structural deficit over the long-term.

However, the consistent increase in base funding indicates the government will not rely on spending cuts to existing programs and services to chart a path to balance, but rather focus on economic growth. That said, this approach may prove to be a political challenge. Certain funding introduced as a result of COVID-19, such as temporary increases to PSW wages, could be increasingly difficult to wind down. It is unclear which of the COVID-19 measures the government includes in Time Limited Funding, but as the province recovers from the pandemic the government will be forced to make difficult decisions to end certain emergency programming.

Recovery Scenarios

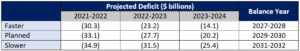

Much like Budget 2020, this Budget presents three economic scenarios depending on the rate of economic recovery: “faster”, “slower”, and “planned” scenarios. The scenarios are dependent on many factors, such as the speed and efficacy of Ontario’s vaccine rollout, how quickly the economy can re-open, and how effectively the government can spur economic growth, encourage new investment, and build the conditions for job creation. These growth scenarios are outlined in the table below, each with a different impact on projected deficits over the medium-term and the date when Ontario could once again see a balanced budget:

Ontario Growth Plan

The importance of rapid economic growth to Ontario’s fiscal health cannot be understated. By taking spending cuts and tax hikes off the table, the government has left itself with one option: creating the conditions for economic success to support the program spending needed now and into the future. To do so, Budget 2021 announced the creation of an Ontario Growth Plan. Not a plan in and of itself, but rather the government’s acknowledgement that a targeted and decisive plan is needed.

The Budget marks the start of the government’s consultation on this plan, expected to draw upon resources and expertise from all sectors of the economy and a wide range of government stakeholders. The Growth Plan will look beyond the immediate end of the pandemic and chart the course for Ontario’s economic recovery over the next five years. Given that the earliest budget balance date under the “faster” – and most optimistic – growth scenario is 2027-2028, the success of the Growth Plan will determine Ontario’s financial footing for years to come.

Key Budget Measures

Protecting the Health of Ontarians

As anticipated, health care received significant funding in the Budget for three areas: COVID-19 vaccination and response, hospital supports, and long-term care rehabilitation. The government announced over $1 billion for a province-wide vaccination plan and $2.3 billion in additional funding for COVID-19 testing and contact tracing.

Hospital Funding: The Budget also outlined $1.8 billion of new funding, for a total of $5.1 billion in funding since last year, to support Ontario hospitals. This money will further help develop 3,100 new hospital beds as the government increases hospital capacity.

Hospital Expansion: The Budget also announced an inpatient wing at William Osler Health System’s Peel Memorial Hospital and the ongoing planning of new regional hospital in Windsor Essex. The government also plans to build new children’s treatment centres in Ottawa and Chatham-Kent.

Long-Term Care Funding: Another $650 million in new funding was announced for the long-term care (LTC) system, bringing the total amount of funding for the sector to $2 billion since last year. The Budget additionally included $246 million over the next 4 years in new funding to improve living conditions in existing LTC homes, including the installation of air conditioning.

Long-Term Care Expansion: The government reiterated their investment of an additional $933 million over 4 years for 80 projects that will result in the creation of 7,510 new beds and 4,197 upgraded beds. In total, the government has invested $2.6 billion in the development of LTC beds. With the new announcements, 20,161 new spaces are in the development pipeline, which represents more than two thirds of the government’s commitment to build 30,000 new LTC beds by 2028.

Supporting People and the Economy

Small Business Support: The Budget announced the renewal of the Ontario Small Business Support Grant through an investment of $1.7 billion to double the program. 120,000 small businesses will automatically see their grants doubled.

Jobs Training: The Budget announced a new refundable Ontario Jobs Training Tax Credit for 2021 to provide up to $2,000 to help people with the cost of re-training — including tuition costs. This will provide $260 million in support to about 230,000 people aged 26 to 65 who have previous labour market experience.

Support for Families: The government is extending the Ontario COVID-19 Child Benefit for the third time with an investment of $1.8 billion to double the benefit amount to $400 per child and $500 for children with special needs.

Childcare Enhancement: The Budget announced $75 million to enhance the CARE tax credit by 20% for 2021, increasing support from $1,250 to $1,500 on average. This will help 300,000 families with their childcare costs.

Tourism and Hospitality: Recognizing the tourism and hospitality industries have been among the hardest hit during the pandemic, Budget 2021 includes $400 million in new support for these industries over 3 years, to total more than $625 million in funding since the pandemic began. Expect a continued focus on the tourism and hospitality industries as the previously announced Tourism Economic Recovery Task Force gets underway.

Broadband Infrastructure: Building on its existing commitment to develop broadband infrastructure in underserved communities, the government announced an additional $2.8 billion for broadband projects. This brings Ontario’s total planned investment to $4 billion over six years – the largest commitment to broadband ever from a provincial or federal government.

What Does this Mean?

As expected, the 2021 Budget attempts to straddle the line between pandemic management and pandemic recovery. Investments in contact tracing, vaccination rollouts, and hospital capacity help to ensure the health care system can continue to handle the stresses of the COVID-19 pandemic. This spending lays the groundwork for a concerted economic recovery effort where the government has clearly chosen to put the recovery of the province’s economy ahead of the recovery of its own finances.

The recovery plan is two-fold. First, economic barriers created by COVID-19 have to be addressed such as the increased cost of childcare done through enhancing the CARE tax credit and direct financial transfers to parents. Next, the focus must shift to adapting to the realities of economic competition in a post-pandemic world. The new Ontario Jobs Training Tax Credit is exactly the type of policy that helps to embrace that change, helping those laid off or struggling to pursue more resilient careers with higher earnings potentials. The largest ever provincial commitment to broadband expansion is another of these recovery focused policies.

However, it is on the recovery front where the government must now focus its attention. In announcing the intent for a new growth plan that will lay out a 5-year vision of growth in Ontario, the government is signaling intent but not much more at this point. The ‘plan to have a plan’ may be the correct approach as government, rightfully, has been completely pre-occupied with the day-to-day impacts of the pandemic, but it still leaves many critical questions unanswered.

Notably, the creation of a 5-year vision and an ever-reducing deficit figure may not line up. It is hard to imagine that a government facing re-election only months after unveiling this plan will resist the temptation to announce large new spending initiatives as part of it. The vision for growth and the goals of deficit reduction – even if it is a nine-year deficit reduction plan – will forever be at odds. To accommodate for this, expect the government to lay out longer term spending goals over a number of years and outline higher level goals that are less tied to spending – such as becoming the lowest regulatory jurisdiction in the country or becoming the country’s leader in foreign direct investment.

It is these long-term goals and policy targets that are the next logical step for the Ford government to grapple with. The pandemic has upended plans to build transit, fix the administrative side of the healthcare system, and get energy costs under control. Today’s document does not reveal plans to solve those thornier and more complex problems, but it does allow the government to get to a place where it can consider those areas to be priorities again instead of solely focusing on lockdowns and vaccine shipments.