2019 Ontario Fall Economic Statement: A Deep Dive

The 2019 Ontario Fall Economic Statement appears to strike the right note between taking budget balance seriously and providing services to Ontarians. Though it does not contain thousands of new initiatives or cuts, it clearly shows the government it attempting to listen and respond to the concerns of Ontarians. Though the pace is slower and the decisions are more deliberate, the outcomes are likely to be better received as well. Ontario’s deficit has been updated to a new total of $9 billion for 2019-20. This is lower than the originally projected number of $10.3 billion for 2019-20 but higher than the $7.4 billion deficit that 2018-19 officially closed with. Despite the back and forth, this is overall progress toward the government’s goal of eradicating the deficit originally stated at $15 billion by 2023-24.

The Finances – Risks to Balance

Despite the forward progress, it would be naïve to assume the government only needs to find $9 billion to balance the budget. First, the government still has many costly promises to deliver on in the future including a more than $2 billion a year income tax cut and a $1.2 billion annual hit to the treasury to cut gas taxes. Though these tax cuts are incorporated in the path to balance, it is important to realize that they need to be paid for over and above the $9 billion number as the impact of those tax cuts is not incorporated in the 2018-19 number.

Second, there are key promises that are not as easy to assume are costed in the plan. Mainly, items like the 12 per cent reduction to electricity bills are potentially not allocated given the policy prescriptions designed to achieve the 12 per cent have largely failed to accomplish the goal to this point.

Third, the government has publicly reversed many savings measures over the past months, including changes to the Ontario Autism Program and the transitional child benefit. These policy reversals are clearly laid out and paid for in the Fall Economic Statement this year. The Ford government has listened to Ontarians on these programs and acted accordingly, but when combined with new spending initiatives they materialize as an increase of $1.3 billion in spending this year. This should not have a large impact on the government’s ability to balance due to revenue growth that more than offsets the increased expenses. The most controversial program decisions have been reversed, so reversals should not continue to feature prominently in the months to come.

The Finances – Positive Signs

Even though there is upward pressure on the deficit figure for a variety of reasons, the Fall Economic Statement has many encouraging signs for the Ford government. The government has experienced continued revenue growth above and beyond initial projections. Corporate tax revenue is up nearly $1 billion this year while personal income tax revenue is projected to be up by over $500 million. A revving economy is not only good for the government that can tout as many as 272,000 jobs created since taking office, but it means the revenue growth is likely to continue to compound and grow. For every dollar the government gains unexpectedly on the revenue side of the ledger, they can ease off of a dollar found via service cuts or program transformation on the other side of the ledger.

Next, the government still has many fiscal levers it has refused to use to this point. The province’s fiscal reserves continue to be projected at $1 billion a year until 2021-22 and then increasing to $1.3 billion and $1.6 billion in the two years after that respectively. The previous government made a habit of dipping into reserves to achieve their fiscal targets. If the Ford government needs to do the same thing to reach balance in 2023-24, or to pay for a one-off cost, they can afford to claw back $600 million that year while keeping the largest reserve in recent memory.

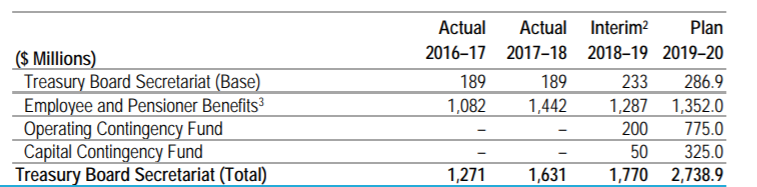

In addition, the government also dramatically increased both operating and capital contingency funds (page 298) within the Treasury Board Secretariat in the 2018 Budget. As seen in the attached graphic, the 2019-20 contingency fund totaled $1.1 billion going into the Fall Economic Statement. The government did reveal that they dipped into the 2019-20 contingency to the tune of nearly $550 million this year. The rest of that contingency fund is still available for unforeseen risks, such as a larger settlement than expected with teachers or a particularly bad flu season. The government’s prudent accounting in Budget 2018 has set them up well for long-term financial success.

New Policy Initiatives

The government’s first Fall Economic Statement saw several major policy announcements from the end of rent control to a new capital cost allowance program for businesses. That statement was a mini-budget, seeing as it was the first fiscal update since taking office. The 2019 Fall Economic Statement aims to give reassurance that the Ford government is listening and taking a calmer approach. There is less urgency for immediate change and instead this year’s Fall Economic Statement can be considered a table setter for the 2020 budget that will be Minister Rod Phillips’ first. That said, there are still some important new initiatives within the statement worth exploring.

Theme 1 – Targeted Relief

The government announced in the Fall Economic Statement that it is moving forward with two of its tax cut promises from the campaign – a reduction in the aviation fuel tax rate for the North and a reduction in the small business tax rate. The aviation fuel tax will be reduced from 6.7 cents per litre to 2.7 cents per litre, costing roughly $10 million a year. The small business rate goes from 3.5% to 3.2% and costs the government a net $40 million annually when fully implemented. Both changes take effect on January 1, 2020.

These specific tax changes also couple with additional investments in small town Ontario. For example, the government recently announced a $100 million economic development fund for rural businesses and they also feature a $68 million increase for small and medium sized hospitals. Expect to see more targeted relief in the months to come. The government needs to show it represents all of Ontario, and with a $28.5 billion transit plan for Toronto already announced, they are focusing on the rest of the province more and more.

Theme 2 – Tackling Complex Economic Problems

Another interesting revelation of the Fall Economic Statement is the government’s willingness to tackle the tougher, more complex files that are not easily communicated in an election campaign or dealt with in the first few months. For example, the government has announced more flexibility and transparency coming to industrial electricity billing and the global adjustment. They have promised to repeal the Toronto Stock Exchange Act while reforming the way capital markets work. They have even promised more action on intellectual property through the previously announced task force run by former CEO of Research In Motion (Blackberry) Jim Balsille. These are not easy items, but if they are done well they can deliver meaningful changes for Ontario’s economy.

Theme 3 – Doing More for Consumers

The government has continued to take consumer initiatives seriously. In this statement, they have endorsed click-and-collect cannabis sales where consumers can purchase cannabis online and collect it from a nearby licensed store. In addition, licensed producers will be able to sell on-site for the first time. On alcohol, the government has indicated it will be introducing legislation to properly delineate who does what between the Liquor Control Board of Ontario and the Alcohol and Gaming Commission of Ontario as the government proceeds towards putting beer and wine in corner stores. Ultimately, the Ford government is keen to ensure consumers and the “little guy” sees themselves reflected in the decisions of this government.